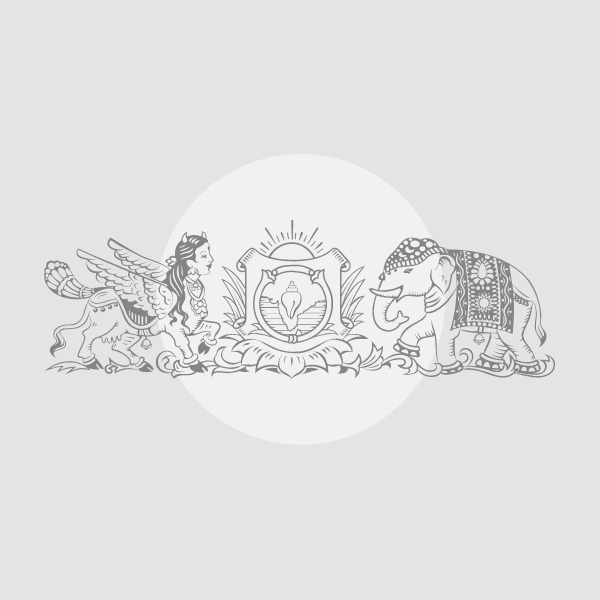

Former RBI Governor Duvvuri Subbarao speaking at a programme organised by the Siddhartha Academy of General and Technical Education in Vijayawada, on Tuesday.

| Photo Credit: K.V.S. GIRI

Former Governor of the Reserve Bank of India (RBI) Duvvuri Subbarao said that although inflation was currently at multi-year lows, growth was reasonably strong at around 6.8 per cent, with the government optimistic that it may even cross 7 per cent. With the rupee remaining broadly stable, RBI is still cautious about repo rate cuts, as it is waiting for full transmission of previous rate reductions to percolate through the economy, he added.

Mr. Subbarao was in Vijayawada to participate in a programme organised by Siddhartha Academy of General and Technical Education (SAGTE) on Tuesday. Global tariff-related uncertainties pose risks to growth prospects and financial stability, he said. Decisions on interest rates, therefore, must consider not only growth and inflation but also the impact on domestic savings, making it far from a straightforward case, he added.

He insisted that maintaining price stability, supporting economic growth and ensuring financial stability were interconnected goals, and said achieving all three simultaneously requires careful balancing rather than simple, linear decisions.

When pointed out that India is on track to become a $5 trillion economy by 2028-29, he said that the real challenge would be to ensure that the benefits of growth were distributed across all sections of society. For this, private investment will be crucial, and the sooner it picks up, the stronger and more sustainable India’s growth trajectory will be, he explained.

Replying to a query on the employment issue, Mr. Subbarao admitted that though more young people were entering the workforce, job quality should improve through policy reforms that ensure productive, well-paying opportunities. He said that for India to truly claim the status of the fastest-growing major economy and to reach the vision of Viksit Bharat by 2047, growth will need to consistently remain in the 7.5-8 per cent range. This demands balanced development and an ecosystem that generates high-quality jobs, he said.

Mr. Subbarao also praised the Unified Payments Interface (UPI) as a transformative tool for financial inclusion and grassroot entrepreneurship. He said that even individuals with minimal literacy were now able to run small businesses using digital payments. “While such transactions may appear small, they give banks valuable insights into customers’ cash flows and business viability,” he explained.

Published – November 25, 2025 09:06 pm IST