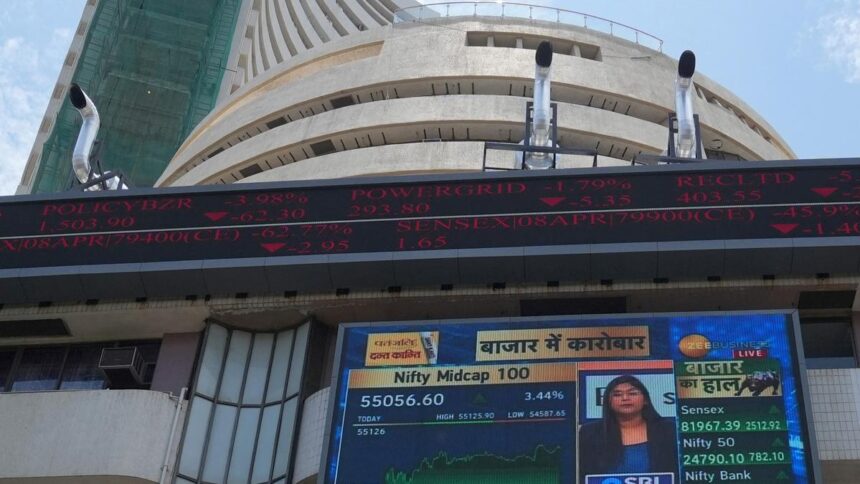

FIIs offloaded equities worth ₹2,566.51 crore while DIIs outnumbered the FIIs by purchasing equities worth ₹4,386.29 crore on August 4, 2025, according to exchange data.

| Photo Credit: PTI

Equity benchmark indices Sensex and Nifty declined in initial trade on Tuesday (August 5, 2025), dragged down by selling in oil & gas shares and persistent foreign fund outflows.

Investor sentiment was further dampened after U.S. President Donald Trump threatened to impose higher tariffs on India over its purchases of Russian oil.

The 30-share BSE Sensex declined by 315.03 points or 0.39% to 80,703.69 in early trade. The 50-share NSE Nifty went lower by 41.80 points or 0.17% to 24,680.95.

Among the Sensex firms, BEL, HDFC Bank, Reliance Industries, ICICI Bank, Infosys, Hindustan Unilever, Adani Ports, Mahindra & Mahindra, Asian Paints, and Tata Steel were the major laggards.

Maruti, State Bank of India, HCL Technologies, Axis Bank, UltraTech Cement, Tata Motors, Titan, NTPC and Bajaj Finance were among the gainers.

“The latest tweet from Mr. Trump that ‘I will be substantially raising U.S. tariffs on India’ for buying Russian oil is a big threat. If he walks his talk, India-U.S. relations will further strain, and the impact on India’s exports to the U.S. can be worse than thought earlier.

“India’s GDP growth and corporate earnings in FY26 will also be impacted. The market, still trading at elevated valuations, has not discounted such an eventuality. It remains to be seen how things evolve. India’s response, with facts, that ‘Targeting India is unjustified and unreasonable’ sends a message that India will not be making undue concessions and compromises,” V.K. Vijayakumar, Chief Investment Strategist at Geojit Investments, said.

This means the market is in uncharted territory in the near-term. If Mr. Trump raises tariffs in India further, the market will react negatively. Investors may wait and watch for the developments to unfold, he added.

In Asian markets, South Korea’s Kospi, Shanghai’s SSE Composite index, Hong Kong’s Hang Seng and Japan’s Nikkei 225 index were quoted in positive territory.

The U.S. markets ended higher on Monday (August 4, 2025).

Global oil benchmark Brent crude dipped 0.33% to $68.53 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹2,566.51 crore while Domestic Institutional Investors (DIIs) outnumbered the FIIs by purchasing equities worth ₹4,386.29 crore on Monday (August 4, 2025), according to exchange data.

On Monday (August 4, 2025), the 30-share Sensex gained 418.81 points to settle at 81,018.72, and the NSE Nifty jumped by 157.40 points to close at 24,722.75.

Published – August 05, 2025 11:02 am IST