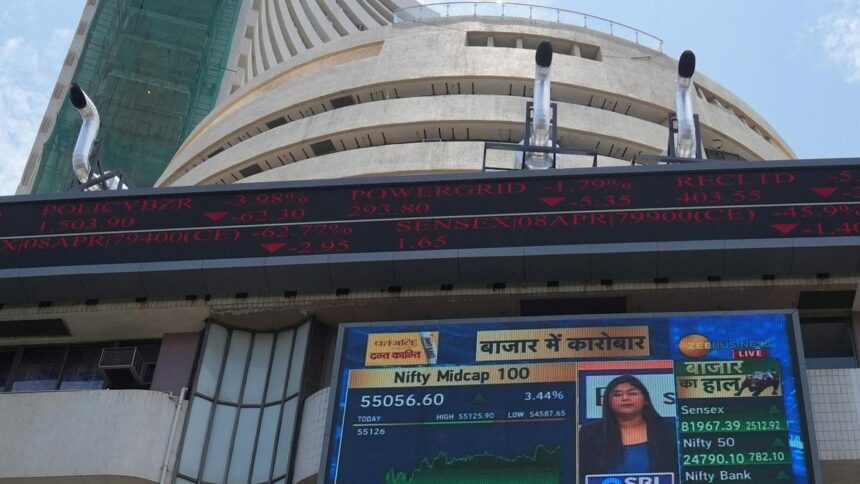

The rupee declined 8 paise to close at an all-time low of 88.18 (provisional) against the U.S. dollar, as Indo-U.S. trade deal uncertainty and weak domestic equity markets pressurised the local unitImage used for representation purpose only.

| Photo Credit: Reuters

The rupee declined 8 paise to close at an all-time low of 88.18 (provisional) against the U.S. dollar on Tuesday (September 2, 2025), as Indo-U.S. trade deal uncertainty and weak domestic equity markets pressurised the local unit.

Forex traders said the rupee is trading near all-time low levels as risks remained skewed to the downside amid uncertainty over U.S. trade tariffs.

Moreover, persistent foreign fund outflows or dollar strength could drive further weakness, they added.

On Monday (September 1, 2025), the rupee revisited its all-time intra-day low of 88.33 against the American currency.

At the interbank foreign exchange market, the rupee opened weak at 88.14 against the U.S. dollar, then lost further ground to an intraday low of 88.20.

The rupee finally settled for the day at 88.18 (provisional) against the U.S. dollar, down 8 paise from its previous close.

On Monday, the rupee closed at a record low of 88.10 against the U.S. dollar.

“We expect the rupee to trade with a slight negative bias as uncertainty over trade tariffs and weak domestic markets may pressurise the local unit. FII outflows and a positive tone in crude oil prices may further weigh on the domestic currency,” said Anuj Choudhary, Research Analyst, Currency and Commodities, Mirae Asset ShareKhan.

Traders may take cues from ISM manufacturing PMI data from the U.S. Investors may remain cautious ahead of the non-farm payrolls report from the U.S. this week, Mr. Choudhary said.

“Markets may also remain volatile ahead of U.S. President Donald Trump’s speech tonight. USD/INR spot price is expected to trade in a range of 87.80 to 88.50,” he added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.63 per cent to 98.38.

Brent crude, the global oil benchmark, was trading 1.80 per cent higher to $69.38 per barrel in futures trade.

On the domestic equity market front, Sensex dropped 206.61 points to settle at 80,157.88, while Nifty declined 45.45 points to 24,579.60.

Meanwhile, Commerce and Industry Minister Piyush Goyal on Tuesday (September 2, 2025) said India is negotiating a bilateral trade agreement (BTA) with the United States.

India has already inked free trade agreements with Australia, the UAE, Mauritius, the U.K. and the four-European nation bloc EFTA, he added.

India and the U.S. have been negotiating the pact since March. So far, five rounds of talks have been completed.

After a 50% duty was imposed from August 27, the U.S. team has deferred its visit to India for the next round of talks, which was scheduled from August 25.

So far, no new dates have been finalised for the sixth round of negotiations.

Amid tensions between India and the U.S., Treasury Secretary Scott Bessent said that at the end of the day, the two great countries will get this solved.

Published – September 02, 2025 04:25 pm IST