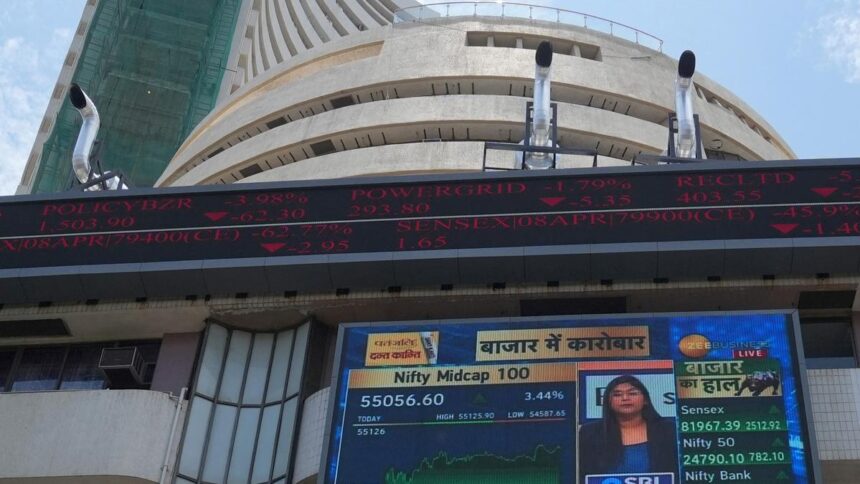

Gold prices fell ₹643 to ₹1,16,945 per 10 grams in futures trade on Friday (October 3, 2025), retreating from record high as investors booked profits amid caution over the US government shutdown and Fed policy outlook.

On the MCX, gold futures for December delivery declined ₹643 or 0.55% to ₹1,16,945 per 10 grams in a turnover of 15,733 lots, snapping a five-day winning streak.

On Wednesday, the contract had scaled a lifetime high of ₹1,18,444 per 10 grams.

Similarly, the February 2026 contract for the yellow metal futures depreciated by ₹646 or 0.54% to ₹1,18,213 per 10 grams. In the previous session, the precious metal had touched an all-time high of ₹1,19,674 per 10 grams.

“Gold prices saw mild profit-taking on Friday, following a sharp rally of nearly 50% so far this year. Despite the pause, the yellow metal remains on track for its seventh consecutive weekly gain,” Darshan Desai, Chief Executive Officer at Aspect Bullion & Refinery, said.

While technical indicators suggested that gold prices are in “overbought” territory and vulnerable to short-term correction, ongoing uncertainty around the U.S. government shutdown and its impact on Federal Reserve policy could limit downside pressure from a stronger U.S. dollar, Mr. Desai added.

“At these elevated levels, investors booked partial profits, with an eye on re-entering during price correction. Lower levels are likely to attract renewed buying interest, particularly from Exchange Traded Fund investors and central banks, he noted.

Commodity markets were closed on Thursday on account of Gandhi Jayanti and Dussehra.

Silver too witnessed a pullback after scaling a fresh peak on Wednesday.

The white metal futures for December delivery slumped by ₹2,170 or 1.55 to ₹1,42,550 per kilogram in 19,818 lots. The contract had hit a record ₹1,45,715 per kilogram on Wednesday.

The March 2026 silver contract tumbled by ₹1,996 or 1.36% to ₹1,44,266 per kilogram in 2,400 lots, after touching a high of ₹1,47,784 per kilogram in the previous trade.

“Silver prices witnessed profit booking after hitting all-time highs in the domestic markets. The U.S. government’s ongoing shutdown extended into a second day on Thursday, potentially delaying key economic data such as the non-farm payrolls report,” Manav Modi, Analyst – Precious Metal Research at Motilal Oswal Financial Services, said.

Globally, gold futures were trading lower at $3,867.15 per ounce on Friday after touching a record of $3,923.30 per ounce in the previous trade. Silver futures for December delivery, however, rose nearly 1% to $46.79 per ounce, recovering from a recent high of $48.01 per ounce.

“Silver is trading near $47 an ounce but remains on track for a seventh consecutive weekly gain, supported by expectations of further U.S. rate cuts and uncertainty from the government shutdown,” Jigar Trivedi, Senior Research Analyst at Reliance Securities, said.

Mr. Trivedi added that recent U.S. macroeconomic data reinforced market participants’ bets on additional monetary easing, with traders fully pricing in a 25 basis point cut this month and another by December.

Published – October 03, 2025 12:01 pm IST