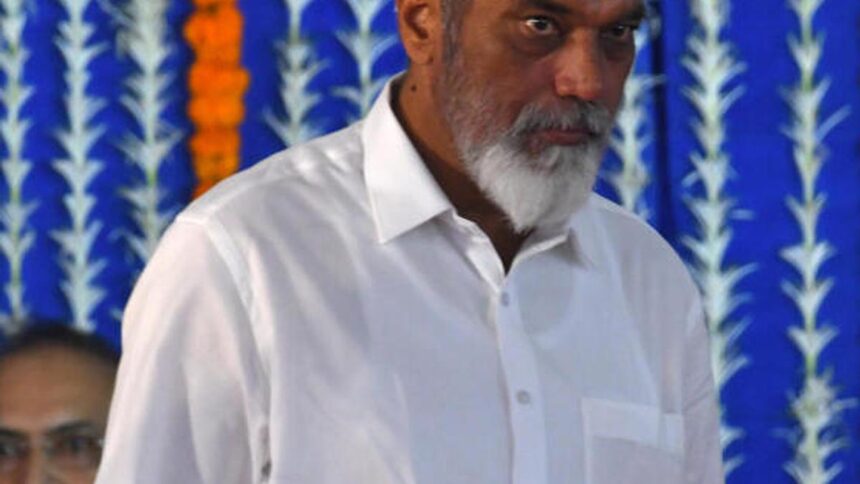

Union Minister of State for Health, Prataprao Jadhav. File

| Photo Credit: PTI

The authorities have detected 61 cases of tax evasion by entities dealing in tobacco products such as gutka, cigarettes and pan masala, amounting to ₹104.38 crore till June this financial year, Lok Sabha was informed on Friday (July 25, 2025).

In a written reply, Minister of State for Health, Prataprao Jadhav said the Department of Revenue has informed that illegal trade of tobacco products is a clandestine activity and hence, the loss of revenue cannot be accurately estimated.

“However, Central Goods and Services Tax (CGST) zones and Directorate General of Goods and Service Tax Intelligence (DGGI) have detected 61 cases of (tax evasion by) gutka/chewing tobacco/cigarettes/pan masala (entities) involving tax amounting to approximately ₹104.38 crore in the current financial year up to June 2025,” Mr. Jadhav’s reply said.

The Minister was responding to a question on whether the government has assessed the extent of tax evasion, illicit trade and unregulated manufacturing in the Zarda sector.

On steps taken to strengthen the enforcement action, Mr. Jadhav said that the DGGI and CGST officers have been sensitised to verify and enhance the level of compliance of registered taxpayers and to identify unregistered entities so as to bring them under the tax net.

The standards of pan masala are prescribed under sub-regulation 2.11.5 of the Food Safety and Standards (Food Product Standards and Food Additives) Regulations, 2011. Any manufacturer of pan masala is required to comply with the requirements specified under the sub-regulation, said Jadhav, who added that no standards of gutka are prescribed under this regulation.

Further, Food Safety and Standards (Prohibition and Restriction of Sales) Regulation, 2011, prevents the use of tobacco and nicotine as ingredients in food products, he added.

Published – July 25, 2025 06:21 pm IST