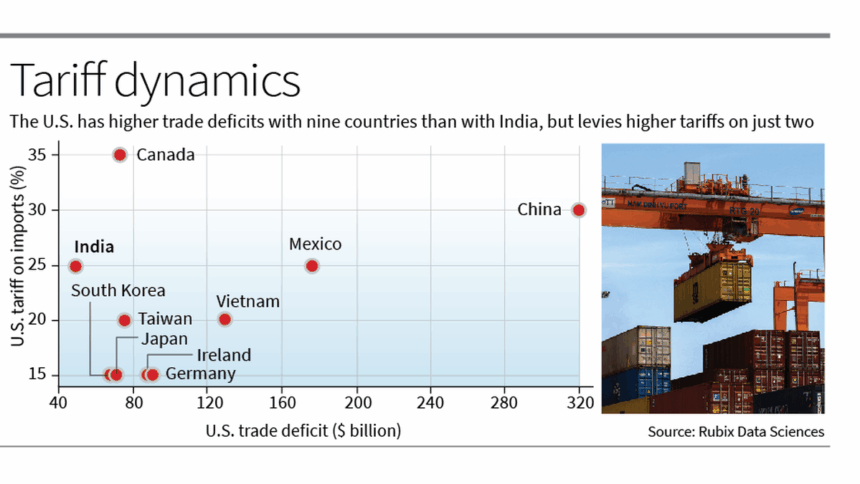

The United States is the real ‘tariff king’, at least in the dairy business, despite U.S. President Donald Trump labelling India as one, said Jayen Mehta, managing director of the Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF), which markets the Amul brand.

Mr. Mehta added that the new U.S. tariffs would not affect Amul’s overseas sales, as demand from the Indian diaspora and even locals remained strong.

In a freewheeling conversation with The Hindu in Gujarat’s Anand, the brand’s headquarters, Mr. Mehta said that while India maintained a uniform 30% import duty on all dairy products, the U.S. imposed much steeper tariffs ranging from 40-75% on items like ghee, butter, cheese, flavoured milk, cream, and shrikhand.

“Amul has been exporting to the U.S. since 1998. Unlike India, the U.S. imposes varying import duties on different dairy products. But, unfortunately, we are projected as a high-duty country, whereas the actual tariff king is the United States, at least in the dairy business,” he said. “Before August 1, the U.S. charged nearly 50% import duty on ghee and butter, 40% on cheese, 61% on flavoured milk products, 40% on cream, and 75% on shrikhand,” he said.

He said milk was the “largest agricultural crop in India,” with over 10 crore families dependent on it for their livelihood, and that the value of milk output in the country exceeded that of wheat, paddy, and oilseeds combined. “It is a vital source of income, and the government has made it clear that this sector will not be leveraged for the benefit of any other. This has been stated explicitly as a policy objective, and the government has also categorically declared that dairy will not be included in any free trade agreement negotiations,” Mr. Mehta said.

When asked about the U.S. market’s response to Amul milk, launched in May last year, he said that in addition to the Indian diaspora, the mainstream market had also accepted the product, and now the milk was being sold in more than 35 States in the U.S. “And it’s not just Indian grocery stores buying it; even mainstream retailers like Costco are also stocking it. For the first time in history, the U.S. is consuming 6% fat milk [compared with the usual 3%].”

Interestingly, it is now locally called Barista Milk, because for making coffee, it needs to be creamy, high in protein, and capable of producing good froth, all qualities of a good coffee milk, he said. “We are selling quite well at nearly double the price of local milk. While regular 3% milk sells for $3 to $3.50 per gallon, ours retails at $6.50 to $7 per gallon.”

Mr. Mehta said that Amul is present in 40 countries and had entered Portugal and Spain in June, and by the end of August, or latest by September, it would be in Switzerland, Germany, and France. “Everything is in place. We are only waiting for the new pack design. In Spain, we will be locally sourcing milk by partnering with cooperatives. Historically, we have not had a presence in Europe, so this marks our first entry into the continent.” “We have four major foreign markets: the Middle East, with an office in Dubai; South-East Asia; Japan, where our business is growing significantly; and of course, the United States,” he said.

Following the trend in the high-demand protein market, he said that the protein is the ‘global currency’, and currently they are offering high-protein buttermilk, lassi, dahi (curd), flavoured milk, and paneer with 50 grams of protein, and they would launch paneer with 70 grams of protein. “The key advantage we have is whey. Every litre of whey contains 0.6% whey protein, while milk has 3% protein. When you make cheese, most of the protein stays in the cheese, but the whey protein that remains is highly valuable. Our protein products taste great because we blend protein into our existing products, rather than going the powder route,” he said.

“In our flavoured milk drink Amul Kool, the protein content is 10 grams, which is deliberately lower, so that customers can gradually move towards mainstream high-protein products. All our products are affordable, value-for-money, high in protein, and of good quality,” he said, adding that in India, there is a severe protein deficit in daily intake, and their objective is to become a part of the daily diet for a healthy lifestyle.

He said that from five lakh litres of whey, Amul produced 20,000 litres of 97% pure bio-ethanol, or rectified spirit, through a process that begins with milk, which is turned into cheese. “The cheese yields whey, from which protein is extracted, followed by ethanol,” he said.

Extending the use of bio-ethanol into the lifestyle sector, Amul now plans to launch perfumes and deodorants by Diwali, leveraging its brand reputation to ensure premium-quality aromas, alongside food sprays to make home-cooked dishes more appealing and give them a restaurant-like touch. “Since we are in the food business – Amul, the Taste of India – we believe taste can also be enhanced through aroma. By Diwali, we plan to launch a range of perfumes and deodorants designed to appeal to all market segments,” Mr. Mehta said.

As Amul expands from dairy into the lifestyle segment, asked whether there was any possibility of an IPO, Mr. Mehta said it would never happen. “As a cooperative, our purpose is the opposite of what drives listed companies…. We’re owned by farmers, so we have to keep them happy as they are our shareholders. If we went public, the pressure would be to show higher profits. The simplest way to do that would be to cut the price we pay farmers for milk and increase the price of products. But that would hurt both farmers and consumers. If both are unhappy, we’ve failed our mission. And we won’t do that just to keep investors happy. We can’t change the character of the organisation,” he added.