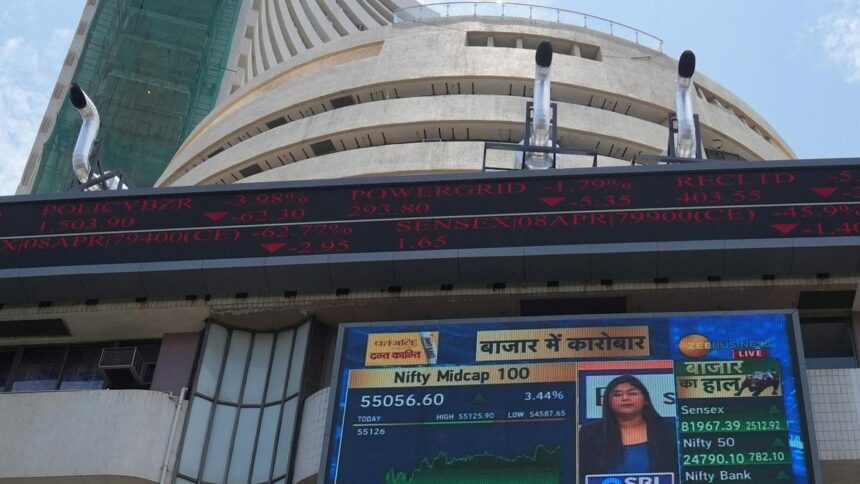

Among the Sensex firms, HCL Technologies, Infosys, Sun Pharmaceuticals, Tech Mahindra, Eternal, Tata Consultancy Services, Mahindra & Mahindra, Bajaj Finance, Reliance Industries and HDFC Bank were the major laggards on August 6, 2025. File

| Photo Credit: PTI

Benchmark indices Sensex and Nifty gave up early gains and were trading lower on Wednesday (August 6, 2025) amid caution ahead of the RBI’s monetary policy decision and unabated foreign fund outflows.

The 30-share BSE Sensex climbed 124.18 points or 0.15 per cent to 80,834.43 in early trade. The 50-share NSE Nifty went up by 21.85 points to 24,671.40.

Later, both the benchmark indices gave up early gains and were quoting lower. The BSE benchmark traded 82.53 points lower at 80,627.72, and the NSE Nifty quoted 29 points down at 24,620.55.

Among the Sensex firms, HCL Technologies, Infosys, Sun Pharmaceuticals, Tech Mahindra, Eternal, Tata Consultancy Services, Mahindra & Mahindra, Bajaj Finance, Reliance Industries and HDFC Bank were the major laggards.

Trent, Adani Ports, Bharti Airtel, Kotak Mahindra Bank, ICICI Bank, Maruti, UltraTech Cement, Asian Paints, BEL, and State Bank of India were among the gainers.

On Tuesday (August 5), the U.S. President Donald Trump renewed threats to raise tariffs on Indian goods over New Delhi’s continued purchases of Russian oil.

Meanwhile, the Reserve Bank of India (RBI) Governor Sanjay Malhotra-headed rate-setting panel, which started the three-day deliberations to decide the next bi-monthly monetary policy on Monday, is scheduled to announce the policy rateon Wednesday (August 6, 2025).

“President Trump’s rhetoric and actions will continue to weigh on markets in the near-term. India’s response to the rhetoric and actions, so far, has been subdued and, of late, strong and measured. India is unlikely to concede to the unjustifiable and unreasonable demands of the U.S. administration.

“This means there will be short-term pains for the economy in terms of lower exports and a marginal hit to our GDP growth in FY26, with the GDP growth declining to around 6.2 per cent from 6.5 per cent estimated earlier. Corporate earnings may also take a minor hit,” V.K. Vijayakumar, Chief Investment Strategist at Geojit Investments, said.

This means short-term pains for the market, particularly since the high valuations provide room for correction. The monetary policy decision on Wednesday is unlikely to influence the market significantly. The overarching influence on the market will be Trump’s tantrums, Mr. Vijayakumar added.

In Asian markets, Japan’s Nikkei 225 and Shanghai’s SSE Composite index were trading in the positive territory while Hong Kong’s Hang Seng and South Korea’s Kospi were quoting lower.

The U.S. markets ended lower in overnight deals on Tuesday.

Global oil benchmark Brent crude rose 0.64 per cent to ₹68.07 a barrel.

Foreign Institutional Investors offloaded equities worth ₹22.48 crore while Domestic Institutional Investors purchased equities worth ₹3,840.39 crore on Tuesday, according to exchange data.

On Tuesday, the 30-share BSE Sensex fell by 308.47 points to close at 80,710.25. The broader NSE Nifty dipped 73.20 points to close at 24,649.55.

Published – August 06, 2025 11:52 am IST