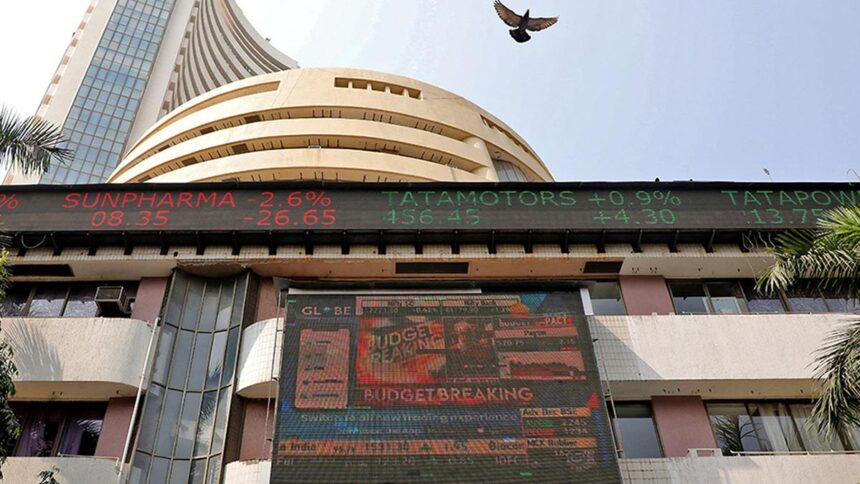

SEBI on July 4 temporarily barred Jane Street from the local market on allegations that it manipulated India’s key indexes, in one of the strongest actions it has taken against a foreign investor. File.

| Photo Credit: Reuters

Jane Street on Wednesday (September 3, 2025) filed a case against India’s markets regulator which has accused the U.S. high-frequency trading giant of market manipulation, according to a case document reviewed by Reuters.

The case has been filed in the Securities Appellate Tribunal, the first point of appeal against regulatory orders.

Jane Street declined to comment in a reply to an email from Reuters. Securities and Exchange Board of India (SEBI) did not immediately reply to a request for comment.

The firm in its filing has said the markets regulator is not providing documents and data that it believes are pertinent to rebut the allegations of market manipulation.

Today’s appeal requests that SAT instruct SEBI to provide Jane Street with the missing materials, said a source with direct knowledge of the matter.

“These documents are undeniably relevant,” the firm said in the court filing.

SEBI on July 4 temporarily barred Jane Street from the local market on allegations that it manipulated India’s key indexes, in one of the strongest actions it has taken against a foreign investor. The firm was asked to respond to the allegations within 21 days of the order, but the deadline has passed.

Published – September 03, 2025 05:48 pm IST