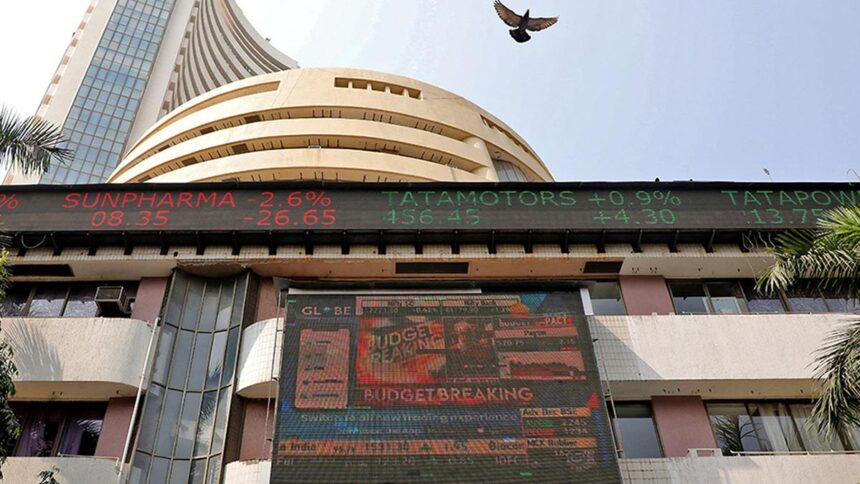

Representative image

| Photo Credit: Reuters

Benchmark equity indices Sensex and Nifty began the trade on an optimistic note on Tuesday (September 9, 2025) in tandem with a rally in global markets amid hopes of a US Fed rate cut later this month.

A rebound in IT stocks also drove the markets higher during the initial trade.

The 30-share BSE Sensex rallied 366.87 points to 81,154.17 in early trade. The 50-share NSE Nifty climbed 101.35 points to 24,874.50.

From the Sensex firms, Infosys, Tech Mahindra, Tata Consultancy Services, HCL Tech, Adani Ports and Larsen & Toubro were among the major gainers.

However, Eternal, Tata Steel, Bajaj Finance and Bharat Electronics were among the laggards.

“Nifty is expected to trade with a positive bias despite volatility, supported by hopes of a quarter-point Fed rate cut on 17th September and the possibility of further cuts in the year’s remaining meetings, keeping bears at bay,” Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd, said.

In Asian markets, South Korea’s Kospi, Japan’s Nikkei 225 index and Hong Kong’s Hang Seng traded in positive territory while Shanghai’s SSE Composite index quoted lower.

U.S. markets ended higher on Monday (September 8, 2025).

“Market is slowly regaining momentum on expectations of earnings boost from GST reforms. Clearly, autos are the major beneficiaries of the GST cut, and rightly, the market has responded positively. News of huge demand for automobiles post-September 22 will keep the auto stocks resilient despite the recent run up,” V.K. Vijayakumar, Chief Investment Strategist, Geojit Investments Limited, said.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹2,170.35 crore on Monday (September 8, 2025), while Domestic Institutional Investors (DIIs) bought stocks worth ₹3,014.30 crore, according to exchange data.

Global oil benchmark Brent crude climbed 0.51% to $66.36 a barrel.

On Monday (September 8, 2025), the Sensex edged higher by 76.54 points or 0.09% to settle at 80,787.30, and the Nifty ended marginally higher by 32.15 points or 0.13% at 24,773.15.

Published – September 09, 2025 10:50 am IST